Trade tensions, tariffs and market uncertainty hit global economic outlook

The global economy faces renewed shocks in 2025 after a brief period of stabilisation, finds data analytics company Euromonitor International.

- Global real GDP growth set to slow amid rising economic pressures, while opportunities remain in certain regions

- Easing inflation in advanced economies contingent on relative trade stability

- Global trade war identified as top risk to global growth

According to Euromonitor International’s Global Economic Forecast Q2, slower-than expected economic growth amid higher tariffs, policy uncertainty and persisting trade tensions are weighing heavily on growth, inflation and stability.

Lan Ha, head of insights at Euromonitor International, said: “Businesses and consumers should prepare for a fragile environment over the coming months. Increased headwinds are a result of disrupted supply chains, worsening trade relations and damaged business confidence. This uncertainty leads to reduced investment and private consumption in the short and medium term.”

Slower global GDP growth amid trade volatility

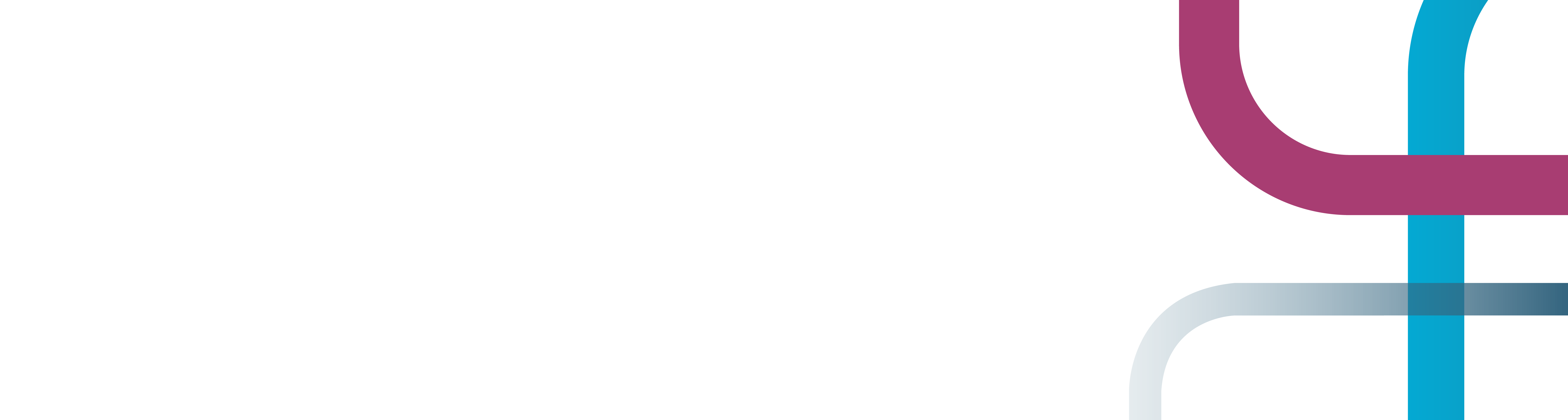

According to Euromonitor’s 2025 global economic update, global real GDP growth is projected to slow to 2.9% in both 2025 and 2026, down from 3.2% in 2024, following renewed economic shocks tied to abrupt changes in US trade policy. While real global growth experienced a decline, certain countries and regions have better weathered the ripple effects of these policy shifts.

Ha noted: “Countries most exposed to international trade, such as China, the US and export-reliant markets are particularly vulnerable. In contrast, diversified economies are displaying greater resilience. New trade routes and supply chains are benefitting countries such as the Philippines and Vietnam, which are expected to be the fastest-growing economies in 2025, driven by robust investment activity and expanding domestic markets.”

More than 10 major economies including the US, China and Eurozone have experienced downward revisions to their 2025-2026 growth forecasts.

Inflation trends show divergence across regions, with volatility threatening tailwinds in advanced economies

Inflation trends show divergence across regions, with volatility threatening tailwinds in advanced economies

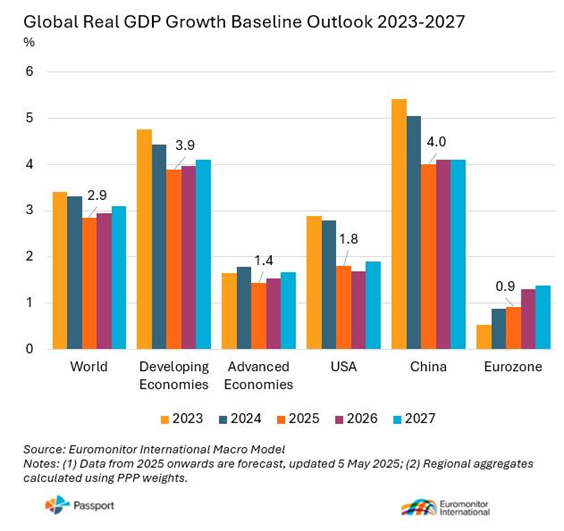

Due to falling energy prices and slowing demand, global consumer price inflation is forecast to ease to 4.1% in 2025 and 3.4% in 2026, down from previous peaks. However, as tariffs threaten to disrupt trade flows, declining import levels may contribute to inflationary pressures in tariffing countries, while reduced international trade will increase price pressures globally.

In advanced economies, inflation is expected to reach 2.5% in 2025, primarily due to anticipated price pressures in the US. In emerging markets, inflation is forecast at 5.3% with potential moderation in export-dependent economies as global demands soften.

Upside inflationary risks remain high, and the possibility of a global trade war is a threat to stability. Structural shifts in the global supply chain from tariffs— like reshoring production and industrial protectionism—could trigger upward price pressures as trade efficiency and productivity decline.

Top three risks facing global growth identified

US policy uncertainty remains the major source of risk to global growth, with Euromonitor International’s Macro Model predicting a 25% likelihood of a Trump Total Agenda scenario unfolding.

Ha added: “This situation would see the global trade landscape severely disrupted due to a surge in tariffs and trade protectionist policies, and a trade war emerge fuelled by equal retaliatory action from trading partners. This would place the global economy at risk of a policy-induced recession.”

Further risks include economic challenges in China which, fuelled by a property sector crisis and population declines, could lead to weakened domestic consumption and heightened deflationary risks. In addition, ongoing geopolitical conflicts like the war in Ukraine threaten to drive renewed volatility in commodity prices that could lead to surging inflation.

For more insights on the global economic outlook see the Global Economic Outlook Q2 2025 report.

Contact Us

Euromonitor Press Office

Press@euromonitor.com

About Euromonitor International

Euromonitor International leads the world in data analytics and research into markets, industries, economies and consumers. We provide truly global insight and data on thousands of products and services to help our clients in unlocking worlds of opportunity®, and we are the first destination for organisations seeking growth.

With our guidance, our clients can make bold, strategic decisions with confidence. We have 16 offices around the world, with 1000+ analysts covering 210 countries and 99.9% of the world's consumers, and use the latest data science and market research techniques to help our clients to make sense of global markets.