Fragrance to drive 23% of beauty growth as ‘Recession Glam’ takes hold

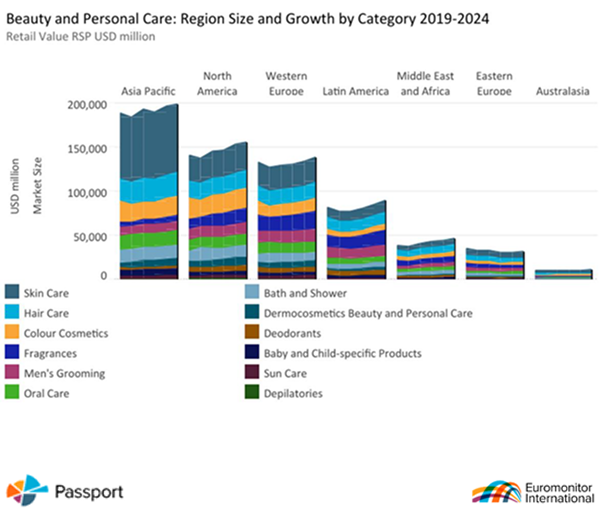

As economic pressures mount, ‘Recession Glam’ reshapes the global beauty and personal care market – valued at USD 593 billion in 2024 – as consumers shift toward low-maintenance, cost-effective beauty routines, according to data analytics company, Euromonitor International.

- Consumers reshape spending habits through cost-effective beauty

- Private label brands dominate prime industry shelf space

- US expected to record highest absolute industry growth between 2024-2029, increasing by over USD 12.6 billion

According to Euromonitor International’s World Market for Beauty and Personal Care report, shoppers are increasingly trading premium for mass brands, seeking products that deliver quality and value.

This shift is evident in lip products and fragrances categories, which offer small indulgences at a lower cost. Fragrances are set to contribute the largest portion of industry growth, accounting for 23% of absolute growth between 2024 and 2029, with a forecast CAGR of 5.5%.

The rise of scent-stacking

The surge of scent-stacking - layering scented products to create a lasting fragrance - allows consumers to reimagine indulgence through affordable luxuries. Consequently, many players turned their attention to body mists, which grew by 7.1% from 2023-2024.

Premium and luxury players are entering the space with fragrance-adjacent offerings that serve as a gateway for budget-conscious consumers. Brands are reacting by investing in exclusive scent profiles and premium packaging.

Yang Hu, Asia Pacific insight manager for health and beauty at Euromonitor International, said: “With inflation front of mind, consumers’ smarter spending is redefining the beauty playbook. The definition of premium is changing – less about price, more about perceived value and purpose.”

Budget retailers target beauty reinvention

With heightened desire for ingredient-driven beauty products, brands and retailers alike are responding with expansion to reach price-weary consumers, and the development of private label products.

US discount retailers began expanding beauty brand offerings, pushing their reach into rural communities servicing value-conscious shoppers. To reach a wider audience, high-growth retail channels target discount stores and warehouse clubs.

Consumers are increasingly visiting warehouse clubs for their bulk-buying value benefits, providing visibility into dupe products, allowing shoppers to discover similar scents and ingredients that spark the same sense of joy as the original products.

Seeking affordable indulgence

In 2024, Asia Pacific accounted for 31% of global industry sales but posted modest growth driven by tighter budgets and a pronounced shift toward more affordable alternatives, from premium to mass.

North America’s performance in 2024 was impacted by a decline in the mass segment, with colour cosmetics seeing the steepest drop, as consumers rebalanced spending priorities to products such as fragrances, with a high daily usage rate.

Western Europe saw an increase in fragrance sales, underscoring consumers’ inclination to seek affordable luxuries, with fragrances serving as a resilient form of personal indulgence , even amid broader economic uncertainty.

These regional trends highlight a global consumer pivot towards accessible indulgence, reshaping the beauty and personal care landscape in an era of economic mindfulness.

Contact Us

Euromonitor Press Office

Press@euromonitor.com

About Euromonitor International

Euromonitor International leads the world in data analytics and research into markets, industries, economies and consumers. We provide truly global insight and data on thousands of products and services to help our clients in unlocking worlds of opportunity®, and we are the first destination for organisations seeking growth.

With our guidance, our clients can make bold, strategic decisions with confidence. We have 16 offices around the world, with 1000+ analysts covering 210 countries and 99.9% of the world's consumers, and use the latest data science and market research techniques to help our clients to make sense of global markets.