Global snack market reaches USD 693 billion in retail sales

Driven by factors such as shifting economic power and changing consumer values, the industry is poised for further growth despite challenges from legislative uncertainties and consumer price sensitivity.

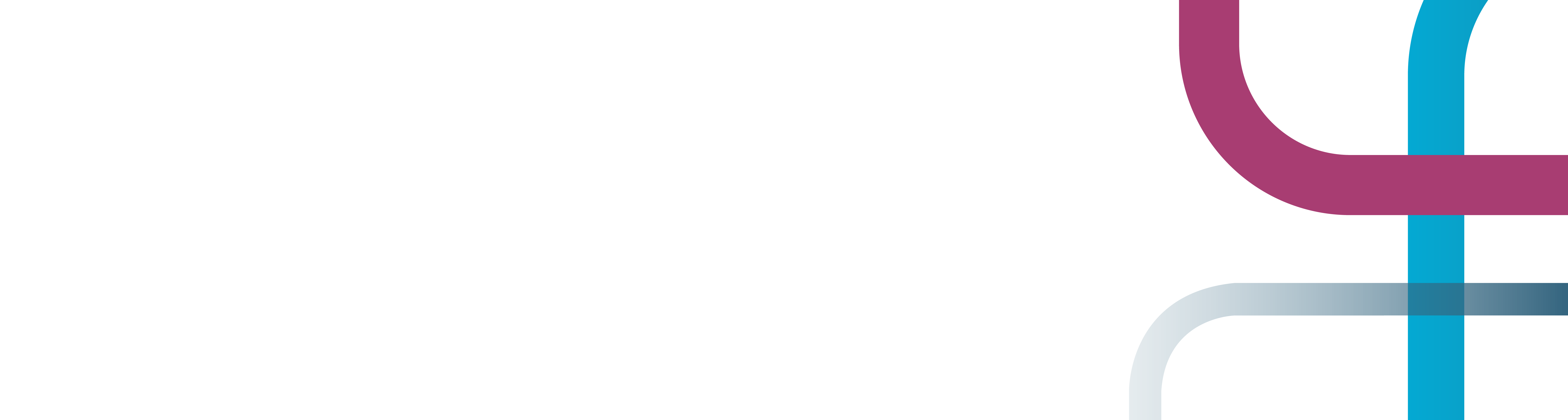

- The global snack market reached USD 693 billion in retail sales in 2024, representing a 2.4% increase

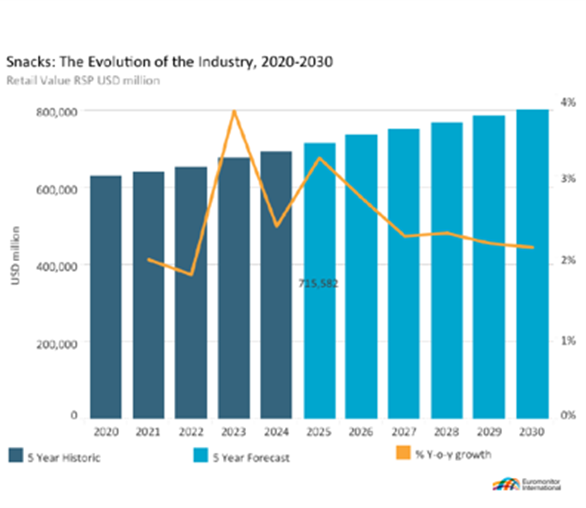

- Savoury snacks remain the leading snack category with a 35% category share

- Innovation in snacks is driving the convergence of industry verticals

The global snack market continues its upward trajectory, reaching USD 693 billion in retail sales in 2024, according to data analytics company Euromonitor International. Driven by factors such as shifting economic power and changing consumer values, the industry is poised for further growth despite challenges from legislative uncertainties and consumer price sensitivity.

Euromonitor International’s World Market of Snacks Report 2025 highlights the industry-wide efforts and projects that the category’s five-year forecast outlook (2025–2030) will outpace its historic performance (2019–2024), as the sector moves beyond pandemic-related strains and intensifies its focus on value-driven upgrades.

Citing the latest findings on snack insights and trends from Euromonitor International’s Passport knowledge hub Carl Quash III, global insight manager at Euromonitor International, said: “In the midst of turbulent tariffs and politics, rising producer costs and dynamic consumer habit shifts, the industry continues to realise a rise in value, resulting in a 4.2% growth to reach USD679 billion in retail sales in 2024.”

Savoury snacks lead global consumer preferences, followed by confectionery

In 2024, savoury snacks remained the leading snack category, accounting for 35% of global value sales, while confectionery ranked second worldwide. Savoury snacks continue to be a consumer favourite; however, a growing appetite for affordable indulgences is also shaping demand, with confectionery serving as a key outlet for value-conscious consumers seeking small moments of treat-driven snack consumption.

Ice cream experienced the sharpest decline of any snack category, while sweet biscuits, snack bars and fruit snacks remained steady due to offering a stronger balance of perceived affordability and value. These shifts highlight consumers’ growing emphasis on cost-effectiveness without compromising enjoyment, suggesting that affordable indulgence will be a key driver of snack choices in the coming years.

Snack brands branch into health and beauty

Snack brands are increasingly extending into the health and beauty sector, using innovation to address consumer wellbeing needs from a fresh perspective. This reflects a broader blurring of category boundaries, where food and personal care intersect to support holistic health.

Notably, one in three global consumers expect to increase their spending on health and wellness in the year ahead, creating opportunities for snack brands to position themselves as lifestyle partners rather than just food providers. By leveraging trust, functionality and innovation, these brands can strengthen consumer loyalty while tapping into new growth avenues.

Quash III commented: “The world is undergoing rapid societal shifts that are reshaping consumerism and redefining the standards that make a snack a worthy purchase. To stay relevant, brands must be proactive and agile, continually evolving to meet changing consumer expectations.”

Contact Us

Euromonitor Press Office

Press@euromonitor.com

About Euromonitor International

Euromonitor International leads the world in data analytics and research into markets, industries, economies and consumers. We provide truly global insight and data on thousands of products and services to help our clients in unlocking worlds of opportunity®, and we are the first destination for organisations seeking growth.

With our guidance, our clients can make bold, strategic decisions with confidence. We have 16 offices around the world, with 1000+ analysts covering 210 countries and 99.9% of the world's consumers, and use the latest data science and market research techniques to help our clients to make sense of global markets.