Zebra striping trend reshapes drinking habits as alcohol market flatlines at 0.6% growth

Although the global alcoholic drinks industry has reached 253 billion litres in 2024, growth appears to be stagnating.

- Consumers are increasingly alternating alcoholic and non-alcoholic drinks to moderate intake

- Only 23% of consumers globally now report drinking alcohol at least weekly in 2025

- Non/low alcoholic drinks market is growing fast, driven by health and lifestyle shifts

‘Zebra striping’ is on the rise as consumers seek to moderate their alcohol consumption, according to research from data analytics company Euromonitor International. Although the global alcoholic drinks industry has reached 253 billion litres in 2024, growth appears to be stagnating.

‘Zebra striping’ refers to a trend where individuals alternate between alcoholic and non-alcoholic beverages during a single social occasion, creating a pattern that helps moderate their drinking. According to Euromonitor International’s World Market for Alcoholic Drinks 2025 report, this form of mindful drinking is becoming popular across all ages and demographics, but is especially evident among younger consumers.

Moderation and sober curiosity replace hedonism

According to Euromonitor International’s Voice of the Consumer: Health and Nutrition Survey 2025, global attitudes toward alcohol consumption are shifting. Alcohol consumption is on the decline, with only 23% of respondents reporting they drink weekly in 2025, down from 25% in 2020.

Among those who consume alcohol at least occasionally, 53% say they are actively trying to cut back — up from 44% five years ago. Notably, the share of individuals who never drink alcohol rose by 3 percentage points since 2020.

This shift is especially evident among younger consumers, as research shows 36% of Gen Z within legal drinking age have never consumed alcohol.

The growing trend toward sobriety is largely driven by a desire to feel healthier (46%) and avoid long-term health risks (42%), along with practical considerations like saving money (30%) and improving sleep quality (25%).

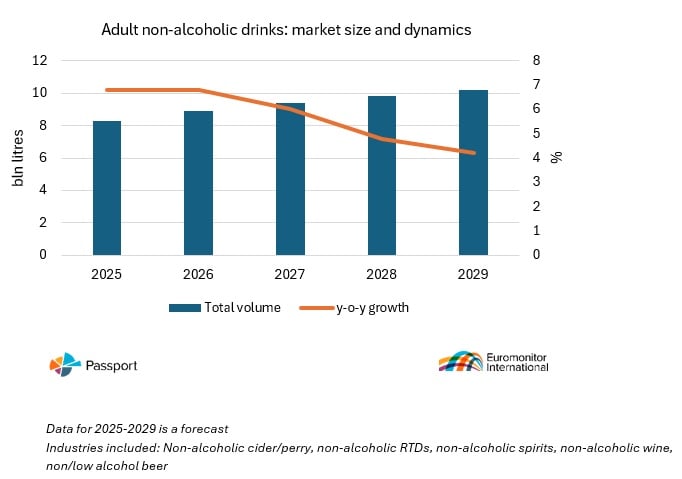

Sobriety spurs adult non-alcoholic market growth

In 2024, the alcoholic beverages industry faced yet another challenging year, marked by modest global total volume growth of just 0.6%, bringing the total market value to USD1.7 trillion.

Meanwhile, non-alcoholic spirits sales grew by 17% in total volume, non-alcoholic RTDs by 14%, non/low alcohol beer by 11% and non-alcoholic wine by 7%. The adult non-alcoholic drinks market is expected to grow by 24% in total volume terms between 2025 and 2029, surpassing 10.2 billion litres in 2029.

Citing the latest findings from Euromonitor International’s Passport knowledge hub, Spiros Malandrakis, global insight manager for alcoholic drinks, said: “While the alcoholic drinks industry continues to face a complex mix of challenges, the adult non-alcoholic beverages market is gaining remarkable momentum across different categories.

“Its consistent growth is not only reshaping consumer preferences but also redefining drinking rituals and social occasions. Non-alcoholic alternatives are no longer niche — they’re becoming a central part of how people choose to enjoy and celebrate, offering fresh opportunities for innovation and repositioning within the broader beverage landscape.”

Contact Us

Euromonitor Press Office

Press@euromonitor.com

About Euromonitor International

Euromonitor International leads the world in data analytics and research into markets, industries, economies and consumers. We provide truly global insight and data on thousands of products and services to help our clients in unlocking worlds of opportunity®, and we are the first destination for organisations seeking growth.

With our guidance, our clients can make bold, strategic decisions with confidence. We have 16 offices around the world, with 1000+ analysts covering 210 countries and 99.9% of the world's consumers, and use the latest data science and market research techniques to help our clients to make sense of global markets.