Value growth of breakfast cereals in Cameroon in 2025 was supported by rising health awareness, demand for convenience, and wider product variety, but adoption remained limited by high prices and entrenched bread-based breakfast habits. Growth was strongest in children’s cereals, driven by parents seeking more nutritious and diverse breakfast options, supported by expanded ranges and shelf space.

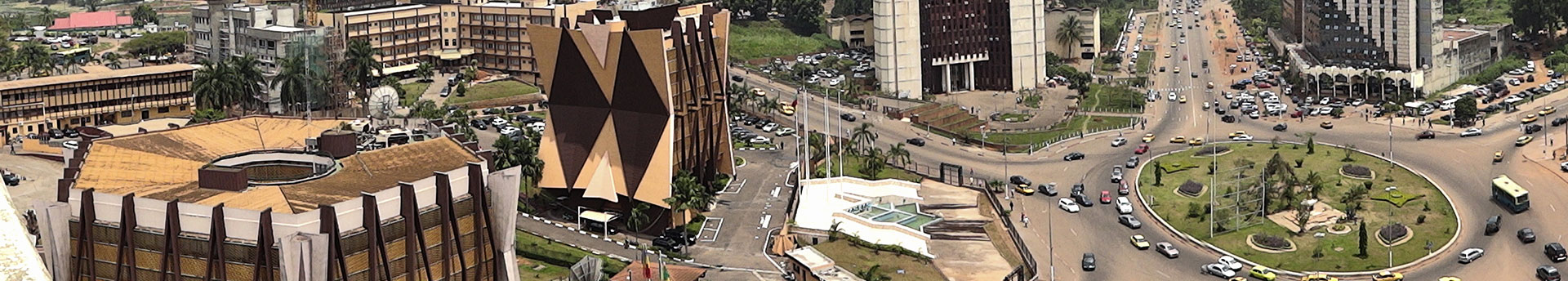

Cameroon

Total report count: 94

- All

- Country Briefing

- Country Report

- Future Demographics

- Sub Regional Country Report

Why buy our reports

- Understand an industry, category and markets quickly

- Robust data from a trusted source

- Comprehensive, data-driven insights

- Leverage our expert knowledge for an unbiased view

Get in touch

Want to find out more about our reports?

Contact us and a member of the team will respond promptly.

Baked goods growth in 2025 was driven by the price stabilisation of bread and the integration of local flours, supported by government wheat price cuts and VAT removal on wheat substitutes. These measures sustained affordability, boosted bread consumption, and supported steady value and volume growth.

Rice, pasta and noodles continued to see solid demand in 2025, supported by population growth, urbanisation and rising prices of alternative staples, which reinforced their role as affordable carbohydrates. Rice recorded the strongest growth, driven by both mass and premium segments. Going forward, significant investments aimed at reducing import dependence, limiting market volatility, expanding local production, and improving affordability are expected to help moderate retail price increases fo

Value sales of processed fruit and vegetables grew in 2025, driven by rising fresh produce prices and the convenience of shelf stable options. Imports of key products, including canned pears, mixed fruits, corn, and peas, have risen for four consecutive years. Going forward, growth will be supported by persistent food inflation, the growing appeal of Western-style offerings amplified by social media, and the time burden associated with preparing traditional fresh staples.

Amid ongoing cost-of-living pressures and persistent food inflation (+5.6%), staple foods in Cameroon remained resilient in 2025, sustained by demand for essential carbohydrate staples, including rice, bread and pasta. Key government interventions, including the elimination of VAT on local flour substitutes (cassava, plantain, and potato flours) and price control agreements with millers struck in 2024 to reduce the price of a 50kg bag of flour by 7%, helped ease price pressures in essential cate

Processed meat, seafood and alternatives to meat recorded modest value growth in 2025. Sharp declines in shelf stable seafood, resulting from a collapse in sardine imports due to food safety scares, continued to weigh on the overall performance, while high prices limited broader consumer adoption.

Healthy volume growth for energy drinks in 2025, as labourers and students look for an energy boost from energy drinks. Locally produced Reaktor brand also continues to dominate. The outlook is also positive over the forecast period, with little concern about the negative health impacts of energy drinks.

Soft drinks is expected to register moderate volume growth, though consumers remain price sensitive, as inflation lingers. There is a shift towards healthier soft drinks, such as bottled water, and also energy drinks, which are perceived as healthy, in spite of high sugar and caffeine content.

RTD tea sees volume sales fall further in 2025. High prices and limited consumers awareness continues to dampen volume sales. The outlook is also bleak, though there could be demand for reduced sugar offerings.

Muted performance in 2025, with limited volume growth, as consumers increasing prefer RTD soft drinks. The high sugar and additive content is also a concern. Liquid concentrates fares better than powder.

Carbonates register a recovery in 2025, with volume sales increasing, after a decline the previous year. There is an increasing range of fruit cocktail carbonates, and orange carbonates also perform strongly. SABC’s launch of a returnable bottle for its Top brand is also proving successful.

Limited supply of safe tap water continues to support volume sales of bottled water in Cameroon. As such, bottled water continues to be seen as a necessity, with still bottled water dominating volume sales, and limited thirst for other options.

What if your smartest decision is just a question away?

Passport is our award-winning knowledge hub for forward thinkers. Demolish doubt and turn your ideas into data-backed strategies.

Juice registers moderate volume growth. However, price increase in its most popular product, that is juice drinks (up to 24% juice), dampen volume sales to an extent. That being said, juice is benefitting from its healthier positioning, compared with carbonates in particular. There is also potential for local players to expand not from concentrate 100% juice.

Soaring cocoa prices dampen volume sales of chocolate-based flavoured powder drinks to an extent, while malt-based hot drinks sees volume sales increase. Small pack sizes and promotions of larger packs support sales. Small local grocers continue to lead distribution, with deep penetration in local neighbourhoods sustaining sales.

While hot drinks registers healthy currently value growth, volume sales fall slightly, due to continuing price sensitivity, amid rising prices. However, in spite of soaring prices for coffee, it register both the highest value and volume growth. Varying pack sizes, including sachets of instant coffee and family pack sizes, sustain volume sales.

There is a sharp decline in retail volume sales in tea, though volume sales increase slight through foodservice channels. Continuing falling output from local tea estates, due to the ongoing Anglophone security crisis, continue to dampen supplies of black tea. Fruit/herbal tea fares better, registering overall volume growth, though this is from a low base. Fruit/herbal is also likely to perform best over the forecast period, as consumers appreciate its functional benefits.

It is an improving picture in in 2025, with coffee registering a slight increase in volume sales, in spite of surging prices. Instant coffee continues to account for most value and volume sales, though fresh ground coffee registers higher growth. Supermarkets are benefitting from the increasing demand for more expensive fresh ground coffee. The outlook is positive, though challenges remain. In particular, EU sustainability measures will increase costs for local exporters.

Sauces, dips and condiments in Cameroon is set to register another impressive performance in current value growth terms in 2025. It continues to profit from the fact that several product types are widely considered basic essentials for preparing popular local dishes, particularly stock cubes and powders, tomato pastes and purées, mayonnaise and herbs and spices. With inflationary pressures steadily easing, greater price stability and a nascent recovery in purchasing power have also helped to lif

Edible oils in Cameroon is poised to record healthy growth in volume and current value terms in 2025. While expansion continues to be underpinned by favourable demographic trends and traditional consumption habits, sales have been further buoyed by greater price stability as supply constraints have steadily eased amidst increased domestic production and rising imports. New launches, promotional activities and improvements in the distribution of different brands and product types have also helped

Sweet spreads in Cameroon is poised to register a substantially improved performance in current value growth terms in 2025, while retail volume sales have bounced back into positive territory following a sharp decline in 2024. Overall demand has been buoyed by greater price stability resulting from the increased domestic supply of vital inputs, most notably cacao and honey. With inflationary pressures steadily receding, a nascent recovery in purchasing power and more frequent discount promotions

Retail volume and current value growth rates for cooking ingredients and meals in Cameroon in 2025 look set to surpass those recorded in 2024. With inflationary pressures steadily easing, overall demand has been bolstered by greater price stability and a nascent recovery in purchasing power. Rapid population growth, deeply ingrained consumption habits and the increasing desire for convenience also remain key sales drivers. Additionally, high levels of innovation, marketing campaigns and improvem

Although current value growth for meals and soups in Cameroon in 2025 is projected to be up modestly on 2024, this is chiefly the result of price hikes imposed to offset still-elevated inflationary pressures. Retail volume sales are set to decline, which would be in keeping with the downward trend observed throughout the review period. It remains by far the smallest of the main cooking ingredients and meals categories, as there is no real tradition of consumption of such products in the country

Economic freedom has worsened and instability has been caused by the recent election, but public debt is low. Helped by slowing inflation and a healthy mining sector, the economy is set to accelerate, but reliance on oil remains considerable. Floods and cuts to aid are exacerbating the humanitarian crisis, but Cameroon’s population is youthful and could lead to a demographic dividend. Internet use is low and innovation capacity is limited, but adoption of mobile technology continues apace.

In 2025, consumer health in Cameroon recorded notable growth, shaped by shifting health perceptions, tightening economic conditions, and the ongoing influence of digital culture. Everyday remedies such as paracetamol remained staple purchases, while strong demand for children’s cough syrups drove a solid performance within paediatric cough, cold, and allergy, particularly for multi-ingredient formulations.

We’ve delivered over 10,000 custom research projects, how can we help you?

What can we help you achieve?

Find the answers to your questions about Euromonitor International and our services.

Get started